Published in Industry

Buy Now, Pay Later: 2025 Guide for Business

Essentials of BNPL

Buy Now, Pay Later is short-term consumer credit allowing customers to make a purchase with later payment options, usually interest-free instalments over several weeks or months. Unlike the traditional credit models, BNPL offers a more seamless, lower-friction checkout process which increasingly boosts online or in-store payment flows.

To merchants, it offers the potential to increase conversion rates, average order value, and customer retention. To consumers, it offers financial convenience with no upfront cost. It’s mostly relevant to younger audiences, particularly those wary of revolving credit balances.

Key Differences

Customers buy with ease in a few clicks

Faster and more global approval

Easy-to-understand terms and schedules

Recent figures show a clear change in behavior: in 2025, nearly 1 in 3 online consumers has used a BNPL product within the last 12 months. For this product type, demand is particularly high within sectors like fashion (42%), electronics (32%), and home goods (26%). Surprisingly, everyday essentials like groceries are also using the technology, with approximately 1 in 4 consumers now using BNPL for covering daily outgoings.

2025 Market Overview

The BNPL market has reached a global transactions volume of approximately $560 billion as of 2025. By the end of the decade, it is expected to reach more than $900 billion, with a 10%+ CAGR in most regions.

Regional Insights

Asia-Pacific is actively implementing BNLP, with mobile-first economies propelling mainstream usage everywhere.

North America continues to grow steadily, especially in omnichannel retail environments.

Africa and the Middle East are expanding at triple-digit rates in some local markets through mobile wallet integrations and underbanked consumer segments.

Europe is facing greater regulatory attention but also large institutional take-up, including from banks and incumbent PSPs.

Market Adoption & Penetration

360 million consumers globally now use BNPL products, with an expected growth to 900 million by 2027.

Merchants offering BNPL at checkout see conversion rate increases of 20–30%, with in some cases order values rising by over 40%.

Over 65% of customers repeat using BNPL within six months, showing high perceived value and increased user loyalty.

2025 BNPL Trends

Entering B2B

Integration of BNPL in B2B is the most underestimated 2025 trend. Companies, especially SMEs, often experience cash flow deficiencies or draconian payment terms with their suppliers. BNPL for business transactions is starting to correct this. B2B BNPL could surpass B2C growth from 2026, especially in sectors like logistics, technology services, and commercial machinery.

Examples of using BNPL in B2B

- A SaaS provider selling annual plans in quarterly payments.

- Wholesale suppliers making 30–60 day payment instalments without affecting their own cash flow.

- Sellers employing hardware and professional gear on flexible terms.

Whereas B2C is based on simpler underwriting, KYB processes, and invoice reconciliation functionality, B2B BNPL will more often require more robust underwriting, KYB processes, and invoice reconciliation capabilities.

Hyper-Personalisation and Dynamic Risk Scoring

BNPL companies are using behaviour data, machine learning algorithms, and other credit scoring methods to customise in real-time. This is a shift from fixed credit products to adaptive credit experiences.

Features include:

- Dynamic transaction-based credit limits.

- Adaptive payment plans.

- Instant behavioural-based fraud detection.

- Personalised payment schedules based on income rhythm.

Retention Through Reward

New businesses are connecting BNPL use and loyalty programs:

- Cashback on repaid BNPL transactions.

- Exclusivity product launches for high-credit shoppers.

- Tiered rewards based on payment history.

This makes BNPL a relationship builder. Enabling BNPL usage with rewards ensures timely payments and promotes higher-ticket baskets.

Challenges and Risks

Despite its popularity, BNPL is a developing technology, with various drawbacks businesses should consider.Here’s what you need to know before launching or scaling BNPL programs:

Delinquency and Overlap of Debt

BNPL has been designed to be easy. More and more users, especially Gen Z, end up having a few short-term instalment plans on platforms without being aware of the overall burden. In 2025, based on surveys, over 41% of customers have defaulted on one or more payments, whereas in 2024 it was 34%. 26% of active BNPL customers have three or more loans simultaneously, frequently across multiple platforms. A large proportion of defaults happen not because people lack the will, but because people lack oversight, they simply forget due dates or overall commitment.

Late payment might not directly affect cash flow for sellers, but consumer discontent due to unexpected fees or penalty charges can harm your brand reputation, especially in highly regulated industries.

Operational & Financial Fragility

Slim-margin BNPL providers have a typical model of revenue based on:

- Merchant service fees per transaction.

- Late charges or interest.

- Consumer data monetisation.

But for that, they have to pay:

- Capital float risk.

- Fraud risk, especially in non-card transactions.

- Default losses, especially in poorer markets.

Some BNPL companies have recorded large losses, some withdrawing from entire markets or turning to regulated lending.

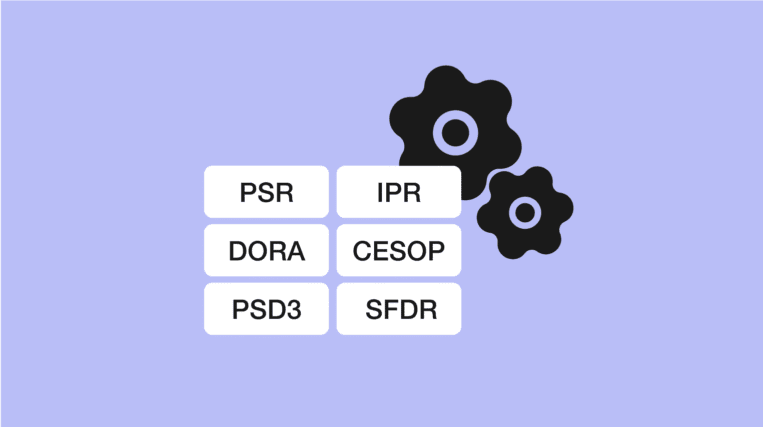

Regulation and Legal Ambiguities

Some countries treat it as consumer credit, others as delayed payments, resulting in massive inconsistencies in how it’s marketed, sold, and used.

New regulatory trends include:

- Forced affordability tests, even on low-value BNPL.

- Publication of APR-equivalent rates.

- Prohibition on co-marketing to low-income customers.

- Reporting to credit bureaus, which could impact credit scores.

In the UK, Australia, and certain jurisdictions in the EU, regulatory restraint is already in progress. To the contrary, certain countries in Latin America and Southeast Asia remain with little regulation. Any business entering BNPL must ensure that their partner is licensed, operates KYC/KYB, and has local compliance updates.

Bad User Experience

BNPL is meant to simplify purchases, but as poorly implemented, it kills conversions. Common UX flaws are:

- Slow approval processes that remove users from the site.

- Too many steps before confirmation.

- Language/currency mismatch in international markets.

- Incompatibility with mobile-first environments.

Studies show frictionless BNPL integration increases checkout conversion by up to 30% and AOV by 40%, whereas poorly executed flows lower conversion by 12–18%.

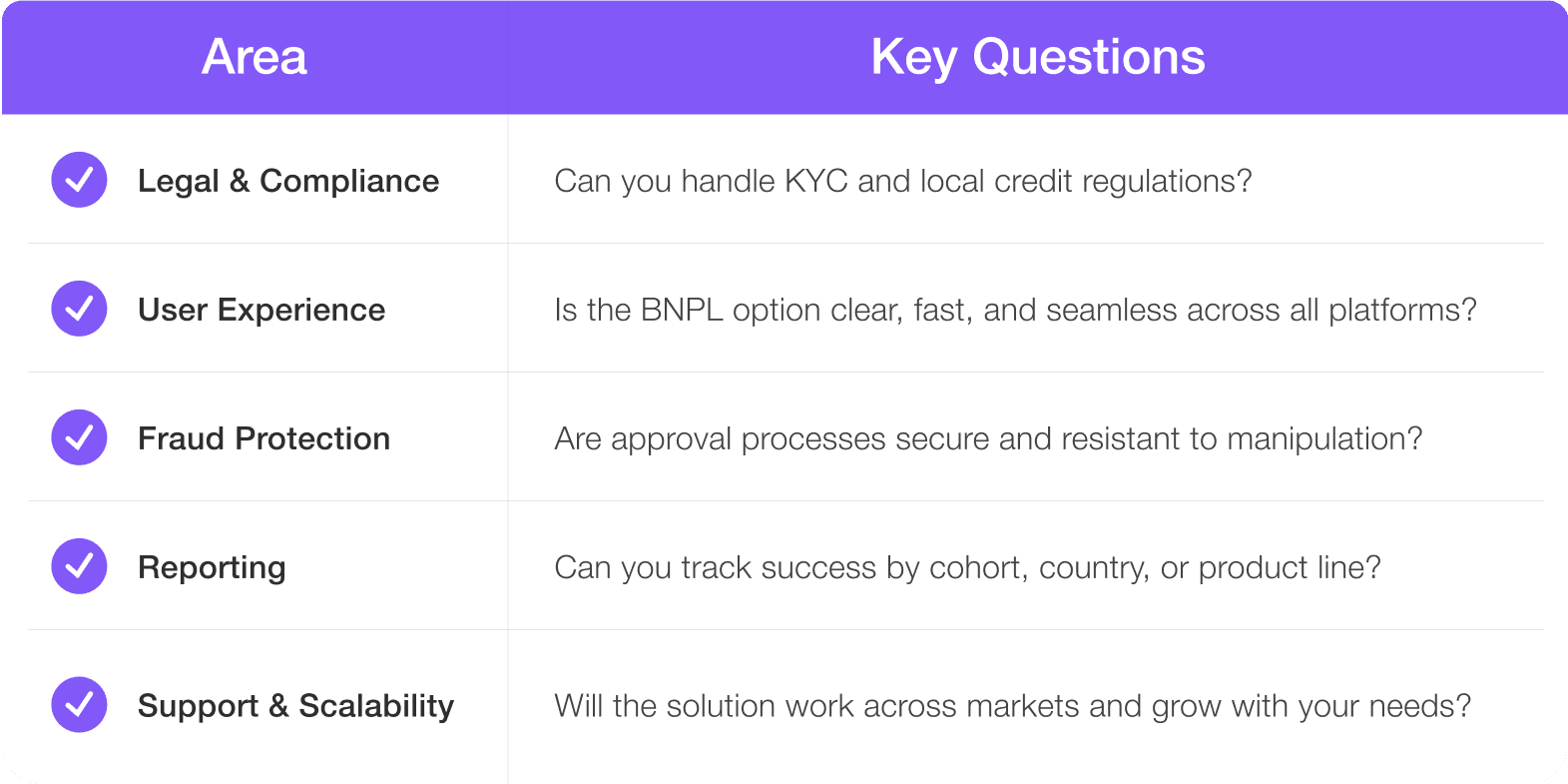

Making BNPL Work for Your Business

Implementing Buy Now, Pay Later (BNPL) correctly requires ensuring security, compliance, scalability, and optimisation.

Before launch, confirm strong fraud prevention, regulatory alignment, system capacity, and a clear, user-friendly payment flow

An enterprise-grade gateway partner which has BNPL integration capacity can handle everything from onboarding to performance analytics.

Some of the top advantages include:

- Fast Integration via API.

- Multi-Currency & Regional Support.

- Built-In KYC, Fraud & Credit Tools.

- Analytics, Control and Optimisation.

- Scalability and Performance Monitoring.

Conclusion

BNPL is transforming how customers and businesses manage liquidity. To achieve its promise without creating operational and financial burden, businesses need to align with experienced third-party gateway partners. With the right payment gateway, BNPL is less of a risk of compliance and more of a growth asset, secure, scalable, and seamlessly integrated.