Published in Deep Dive, Go-to-Market, Industry

Checkout Isn’t Broken, It’s Just Foreign: How to Use Local Payment Methods Properly

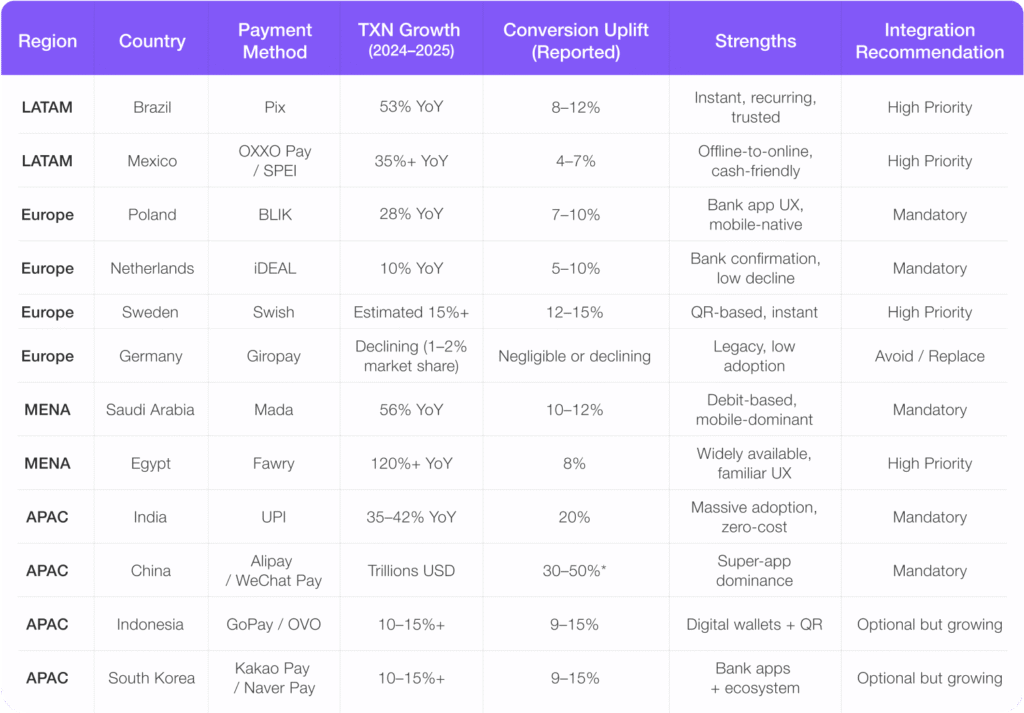

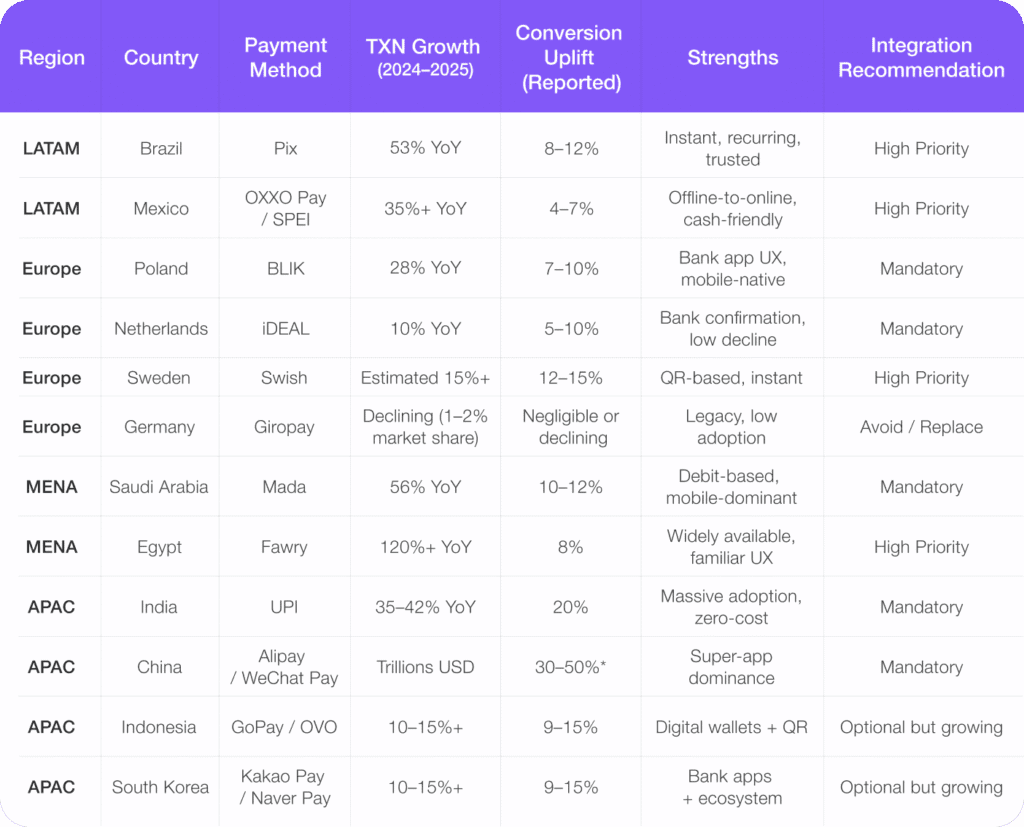

Did you know that merchants who offer local payment methods experience up to 40% fewer drop-offs and 6–15% better conversion rates than those who rely on cards?. Yet most companies going cross-border still treat checkout as a technical checkbox: offer Visa, maybe PayPal, and fingers crossed. But what actually happens is friction. The consumer is shown a foreign interface, an unfamiliar process, and bails. This article explores the local payment methods across LATAM, Europe, MENA, and APAC and their impact on the local and cross-border business operations.

LATAM

Pix as the New Standard

No market more exemplifies the changes in domestic payments than Brazil. Pix, created by the Central Bank of Brazil, has achieved what card networks were unable to: unite the population on one real-time, frictionless rail.

By the end of 2024, Pix was processing more than 6 billion transactions per month, far outpacing debit and credit card volumes. In December alone, Pix moved nearly $4.5 trillion USD, an increase of 54% year-over-year. Pix is not just fast, but solid, cheap, and ubiquitous. Most customers can initiate a Pix payment in a few taps from within their banking app or via QR code. No card entry, no risk of rejection by issuer logic, and no waiting for settlement. That immediacy translates into completed checkouts and better cash flow.

Brazilian retailers that adopted Pix experienced 8–12% conversion rate increases, especially among mobile-first shoppers. One mid-size fashion retailer noticed that shoppers who used Pix completed purchases 17% faster than card users, with 30% fewer checkout abandonments. And unlike cards, Pix fees are low, enabling businesses to improve margins as they drive volume. Add in the new recurring and installment functionality, and Pix begins to go head-to-head with e-commerce’s most fundamental credit use cases.

SPEI and the Power of Hybrid Cash

Mexico’s payment ecosystem is even more fragmented than Brazil’s, but domestic methods are just as significant. SPEI, the central bank’s real-time transfer system, has grown steadily, particularly in peer-to-peer and B2B flows. In 2025, its role in e-commerce is being enhanced by hybrid models like OXXO Pay, which intermediates digital checkout and the country’s cash-based culture.

Here is how it works: at checkout, consumers who do not want to use cards select OXXO Pay and receive a barcode. They pick a local OXXO convenience store from over 20,000 locations across Mexico, and pay cash. The system does a real-time settlement through SPEI, clearing the transaction on the merchant backend. This model is incredibly successful with underbanked or unbanked consumers. OXXO Pay usage in e-commerce increased more than 35% between 2023 and 2025, with comparable average basket sizes to card transactions. Fashion, electronics, and ticketing sites have seen 4-7% net conversion increases by simply having OXXO Pay as an option.

Europe

BLIK as Default Digital Checkout

BLIK started as a simple way for people to pay each other. Now, it’s the top payment option for online shopping in Poland. In just the first three months of 2025, there were over 325 million online payments made using BLIK. That’s a 23% jump from last year, adding up to about €11.6 billion. BLICK is frictionless. Users approve payments directly from their banking app, no cards, no redirects, no form-filling. It’s mobile-native, bank-backed, and trusted. And it’s fast: payments settle in real time, which means faster order fulfillment and better cash flow for merchants.

Retailers that have taken BLIK have seen 7–10% boosts in conversion rates, with a particular uptick for returning mobile users. For subscription services, BLIK’s recurring and postponed-payment capabilities, such as BLIK Pay Later. For companies expanding into Poland, failing to integrate BLIK is the wrong signal to send. It says “foreign” and risky.

DEAL Means Business

Dutch consumers made 1.47 billion payments using iDEAL in 2024, up 10% year-on-year. Total iDEAL volume was €141 billion, nearly on par with debit card combined volume in the country. The success of the system lies in simplicity: real-time bank transfers, approved within a familiar bank environment, and no card friction. Cross-border merchants notice 5–10% conversion rates after they enable iDEAL, even if they accept cards and PayPal. Dutch shoppers expect to see iDEAL. If they do not, they will leave. The logic is simple: why retap card information, risk fraud alerts, or rely on unrecognized gateways when your bank can settle the payment in two clicks?

For companies targeting the Benelux market, iDEAL coverage is step one. And with the iDEAL 2.0 project refreshing APIs and broadening functionality in 2025, the cost of being outside the system will only grow.

Swish Is Quietly Eating Checkout

In Sweden, the payments are QR- and mobile-native. Swish, formerly a P2P solution backed by Sweden’s banks, has become a driver of conversion in mobile commerce. Swish has over 8 million active users by 2025 and is used for everything from paying parking tickets to splitting dinner. Merchants integrating Swish experience 12–15% mobile checkout completion rates, citing reduced friction and faster payment confirmation. The experience is highly optimized for mobile and built on trust: no third-party redirects, no card decline errors, no checkout anxiety.

Giropay’s Decline and What It Teaches Us

Germany, meanwhile, serves as a caution. Giropay, a promising domestic scheme, has not been able to maintain the pace. Uptake, in spite of the bank-centric character, remains at 1–2% of online payments, and many German banks are actively discontinuing it in favor of open-banking APIs or private wallets. German retailers must now think more holistically: which domestic alternatives do consumers rely on, if not Giropay? Sofort, SEPA push, or even fintech-powered wallets are the likely solution.

For fintechs operating in Germany, Giropay’s demise serves as a reminder: no payment method is forever. Agility is the answer. The ability to add, substitute, or retire local methods without affecting merchants is a necessary trait of any contemporary gateway stack.

MENA

Mada Reigns Supreme

In Saudi Arabia, the local payment network Mada succeeds beyond debit usage. In Q1 2025, SAR 69.3 billion of e-commerce expenditure used Mada, reflecting over 370 million online transactions. These numbers constitute a shift: over 90% of Saudi e-commerce is now mobile, and merchants experience 10–12% higher conversion rates for Mada-enabled checkouts. The payment flows are fast, secure, and completely familiar to Saudi consumers, eliminating friction and establishing brand trust.

Fawry: Cash Digitized

In 2024, Fawry, a bill-pay and e-commerce gateway, handled over 30% of all online payments, showing a year-over-year growth of more than 120%. Local merchants experienced +8% conversion increases once Fawry was added at checkout. In a nation where paying with cash upon delivery was standard, Fawry enabled immediate payment processing while keeping familiar routines intact. Checkout sessions remained seamless while expanding audiences.

APAC

UPI’s Digital Overthrow

In Q1 2025, UPI processed over US$211 billion in payment value and more than monthly volumes exceeding 12.5 billion transactions. UPI drives 80% of India’s retail transactions with over 500 million active users. Merchants who offer UPI at checkout experience +20% conversion enhancement compared to card-only approaches.

Alipay & WeChat Pay Are a Must for Cross-Border

Even for cross-border, Alipay and WeChat Pay are inevitable for international merchants. These channels dominate everyday life in China, processing trillions annually. If you don’t accept them, you’re leaving 30–50% potential conversion on the table. While China’s domestic methods are closed, both WeChat Pay and Alipay now enable international merchants, especially tourism, luxury, and travel brands, to access tens of millions of paying users. Not offering them means checkout friction and missed opportunities.

Why Local Payment Methods Convert

There is both a technical and psychological aspects behind each conversion rate:

Local payment methods eliminate foreign-language forms and extra verification. A shopper using a trusted local option - like iDEAL in the Netherlands - is far more likely to complete checkout than with an international card form

QR scans, bank apps, and wallet barcodes dominate mobile-first commerce. With over 70% of global purchases happening on phones, local mobile-native methods dramatically boost conversion and convenience

Real-time payment systems like Pix, mada, and UPI remove processing delays. Transactions clear instantly, orders update in real time, and fraud risk drops - boosting trust and cash flow

When payment confirmations look and feel local, customers feel secure. Domestic methods routinely deliver 5–20% higher conversion rates across APAC and mobile-first markets

Integration Challenges

Each local rail differs in API and compliance, so one unified integration isn’t possible -every market requires its own build

Real-time methods demand country-specific KYC, AML, and reporting. Compliance isn’t global - it’s local, and it changes fast

Multi-currency flow manual processing, payout schemes, and reconciliation increase operational risk and take weeks or days

New features require updates per route or region. Slow vendor cycles mean missed opportunities for merchants and users

Partnering with a reliable white-label payment gateway can help to reduce this complexity:

Connect Pix, BLIK, Swish, Alipay and dozens more through one API - no extra certifications, no redeployments, no local build headaches

We manage point integrations with local providers inside the product, so you can expand coverage faster without juggling few vendors

Track key metrics like conversion, approval rates, and payment success by country or method - all in one easy-to-read view

Enable Pix Automático or QR Pay globally with one toggle, while keeping users in your branded checkout for a consistent, trusted experience

Conclusion

Local payment methods are a reliable and integral part of maximizing your online experience and conversion. Merchants from Latin America to Southeast Asia that speak their customers’ payment language natively see measurable revenue growth. For businesses aimed at international expansion, building all of this internally simply doesn’t scale. White-label gateways offer the speed, compliance, and UX you require while enabling you to maintain ownership of narrative and profit.

Ready to add Pix, BLIK, UPI, Mada, and Alipay with your branding? Let’s discuss how our gateway can get you up and running quickly, improve conversions, and expand internationally. Reach out today to boost your future business