Published in Go-to-Market

How to Start a PSP in Europe in 2025

As of 2025, the value of the global Payment Service Provider market is $87.16 billion and is projected to reach $140.91 billion by the year 2034 at a CAGR of 5.48%. In Europe alone, the digital payment market itself will increase to €131.03 billion by the year 2035, maintaining a CAGR of more than 15%.

The growth is driven primarily by the rapid mainstreaming of digital wallets, and fast adoption of real-time payment, Open Banking APIs, and API-first infrastructure. These developments are also promoted by the European Central Bank’s initiative towards payment sovereignty through initiatives like the digital euro and local wallets, along with stricter regulatory policies like PSD2 and future PSD3. The attractive market is open for those who know how to effectively launch a PSP. In this article we will analyse the key nuances businesses should consider running a PSP in Europe.

Business Model

A PSP is more than simply facilitating payments. It acts as an intermediary between merchants, banks, networks, and end customers, and delivers a mix of infrastructure, security, compliance, and value-added services to facilitate businesses to transfer money with velocity and dependability.

The standard design of a PSP includes the following components:

Real-time payment processing across cards, bank transfers, digital wallets, and other methods.

Checkout solutions and payment orchestration platforms with dynamic routing.

Fraud detection tools, chargeback management, and risk scoring engines.

Recurring billing, tokenisation, and one-click payment support.

API documentation, sandbox environments, and merchant onboarding flows.

Reporting tools, analytics, and dashboards for transaction monitoring.

European Regulations

Any business offering payment services across the European Economic Area is under a complex regulatory regime, driven primarily by the EU’s Payment Services Directive.

PSD2 and PSD3

The Revised Payment Services Directive transformed the EU’s digital payments market with the imposition of critical requirements such as:

- Strong Customer Authentication, requiring multi-factor authentication on most transactions.

- Open Banking access, requiring banks to open APIs to qualified third-party providers.

- Tighter security, operational, and transparency standards for licensed institutions.

PSD3, due in 2026, is expected to consolidate and expand on many of PSD2’s requirements, with clearer differentiation between fintechs, wallets, and electronic money institutions, and an even stronger emphasis on cybersecurity.

To operate as a legal PSP in Europe, businesses must have a Payment Institution license, for activities such as acquiring, money remittance, and direct debits, and Electronic Money Institution license, for companies issuing and storing electronic money, such as wallet services.

Licensing is carried out on a national basis and may take 6 to 12 months. Typical requirements are:

- Proof of minimum capital reserves, ranging from €20,000 to €350,000 depending on service).

- A sound business and operations plan.

- AML/KYC policy, data protection structures, and anti-fraud controls.

- Appointed compliance officers and audited financial forecasts.

Market Entry Strategy

The PSP market in Europe is increasingly fragmented, with opportunities for new players capable of delivering localised, specialised, or technically differentiated solutions. Successful PSPs target niches rather than trying to address all comers from day one.

Common segmentation strategies include:

E-tail, digital goods, SaaS providers, and education businesses in highly regulated economies.

Verticals like igaming, crypto, etc. Very profitable but require more fraud monitoring and underwriting controls.

Businesses that require multi-vendor payouts, embedded finance, or smart settlement logic.

A fast-growing segment that values simple onboarding and elastic pricing.

A deep understanding of the expectations, pain points, and regulatory burden of each segment allows new PSPs to tailor onboarding, product functionality, and support accordingly.

Building a Scalable PSP

Getting a PSP to market in 2025 is not only a matter of software development or licensure. Success now depends on how effectively a company can ensure the broader financial ecosystem, cooperating with trusted partners to gain go-to-market, manage risk, and scale into multiple regions or verticals. The right partnerships combined with smart infrastructure decisions dictate operational viability and long-term competitiveness. To deliver stable and secure services across Europe, PSPs must get aligned early with various types of partners:

Acquiring Banks

These banks form the transactional backbone of any PSP by enabling card acceptance and settlement. Access to one or more acquirers, particularly those with local operations in target markets, improves transaction approval rates and allows for optimised routing for cross-border payments.

Global Card Schemes

Network integrations with Visa and Mastercard, for instance, grant access to global merchant acceptance. The schemes also mandate significant compliance requirements, such as 3D Secure, that set the legal and security baseline for card payments in Europe.

Fintech Infrastructure Providers

Instead of developing each function internally, most PSPs integrate modular services from fintech enablers. These include:

- Automated AML and KYC

- Real-time fraud detection and chargeback management

- Identity and tokenisation verification

SaaS and Commerce Platforms

Integrations with platforms, or embedded billing software make onboarding easier for small and medium businesses. In B2B setups, integrations with ERP or CRM systems can allow PSPs to offer contextual, recurring, or invoicing-based payment solutions.

Legal and Regulatory Specialists

PSPs operating across multiple European jurisdictions must contend with differences in licensing, interpretations of PSD2/PSD3, and data protection enforcement. Cooperation with legal and compliance experts is crucial for risk mitigation and avoidance of operational delays.

White-Label Infrastructure

For most newcomers, the barrier isn’t so much compliance or establishing partnerships. It’s simply the complexity of creating a secure and scalable payments infrastructure. CodeVision white-label platform offers a ready-to-launch solution. Rather than investing heavily in development, certification, and in-house operational investment, PSPs can cooperate with CodeVision payment gateway to launch their own branded solution rapidly, securely, and effectively. Key benefits include:

Time to efficiency

Go live in weeks, not months. CodeVision reduces development time by providing a launch-ready, compliant platform.

Brand control

PSPs can fully customise the user experience, from checkout and back-office portals to dashboards and domains without writing a single line of code.

In-built functionality

The platform supports:

- Multi-currency and multi-method payments

- Smart routing and cascading logic

- Subscription billing and one-click checkout

- DСС and transaction fee management

- Advanced analytics and reporting tools

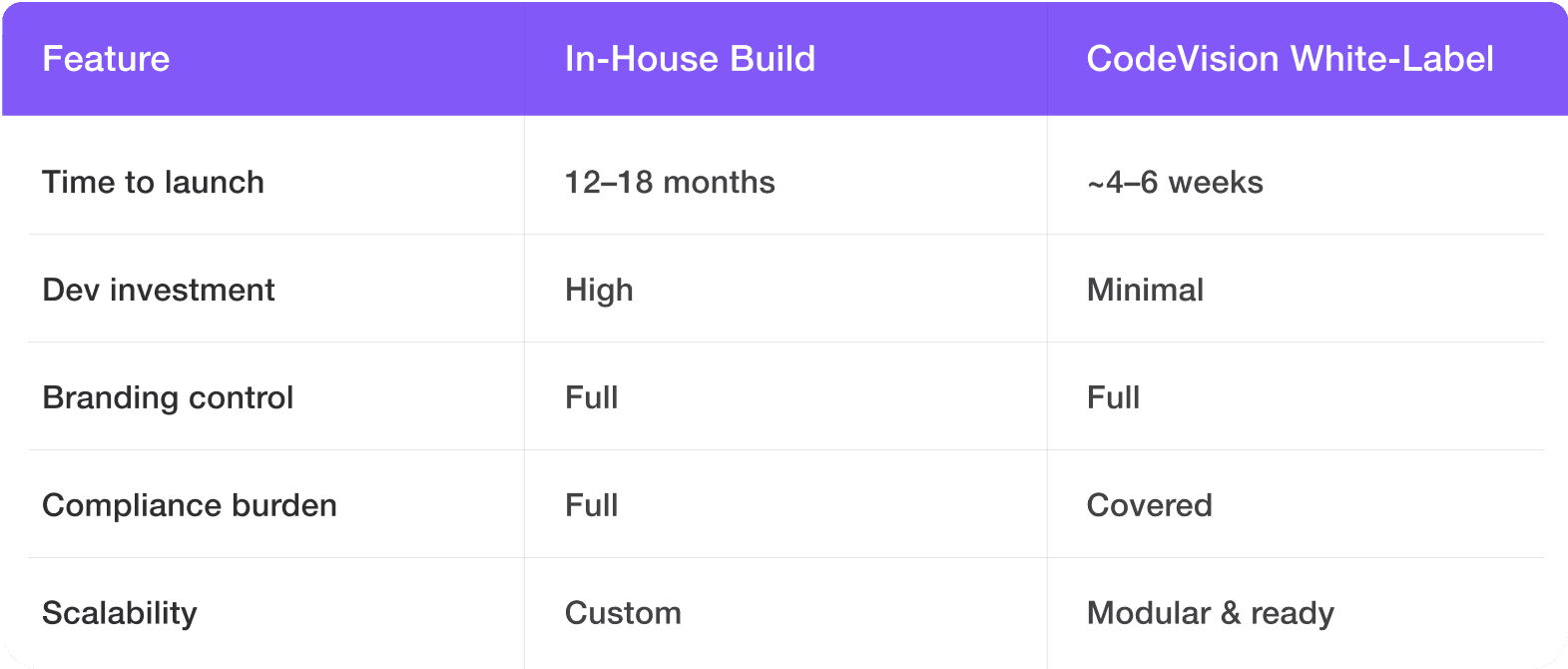

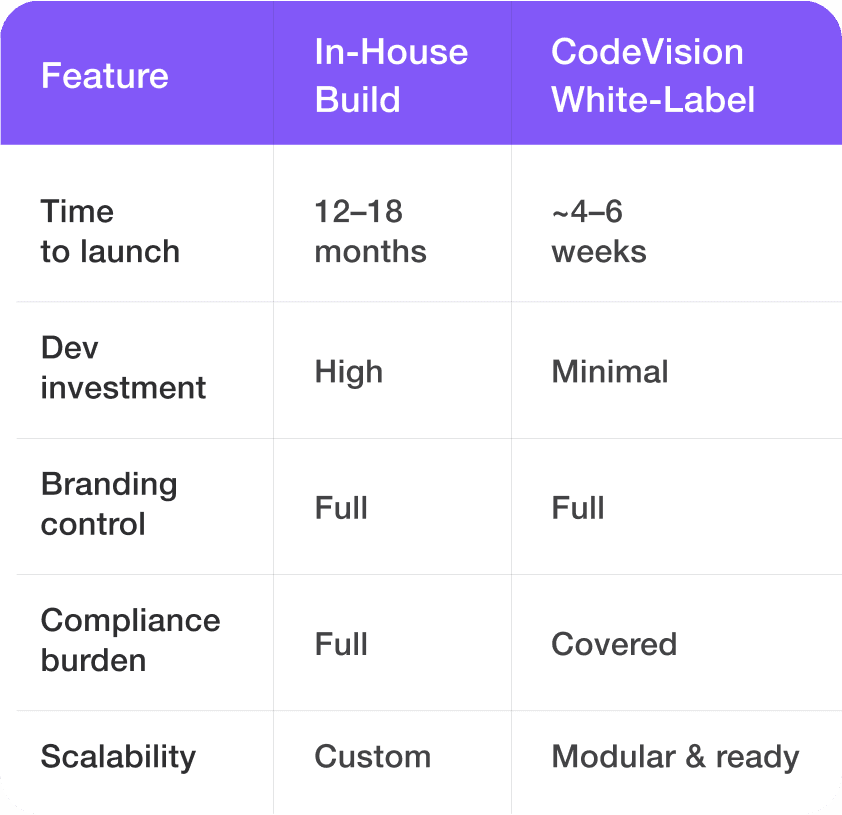

Two Options

Build in-house

Build your own gateway, buy licenses, develop engineering and compliance personnel, and have all levels of infrastructure owned. This option provides total control but consumes loads of time, capital, and operational sophistication.

Launch a white-label platform

Use a pre-existing solution like CodeVision to deliver under your own brand. This reduces the expense and effort of establishing or certifying infrastructure, enabling immediate market entry with full merchant control, customisation, and compliance incorporated.

Your own strategy is a matter of your budget, timeframes, and in-house skills. But the principles remain the same.

Conclusion

Europe’s payments industry has various opportunities. With the right partners, a good go-to-market plan, and an infrastructurally scalable option, building a PSP would be very feasible. The market is growing, the technology is available, and the regulatory frameworks are clear with the right expertise and cooperation.