Published in Deep Dive, Industry

Operating in Europe: PSP Compliance in 2025

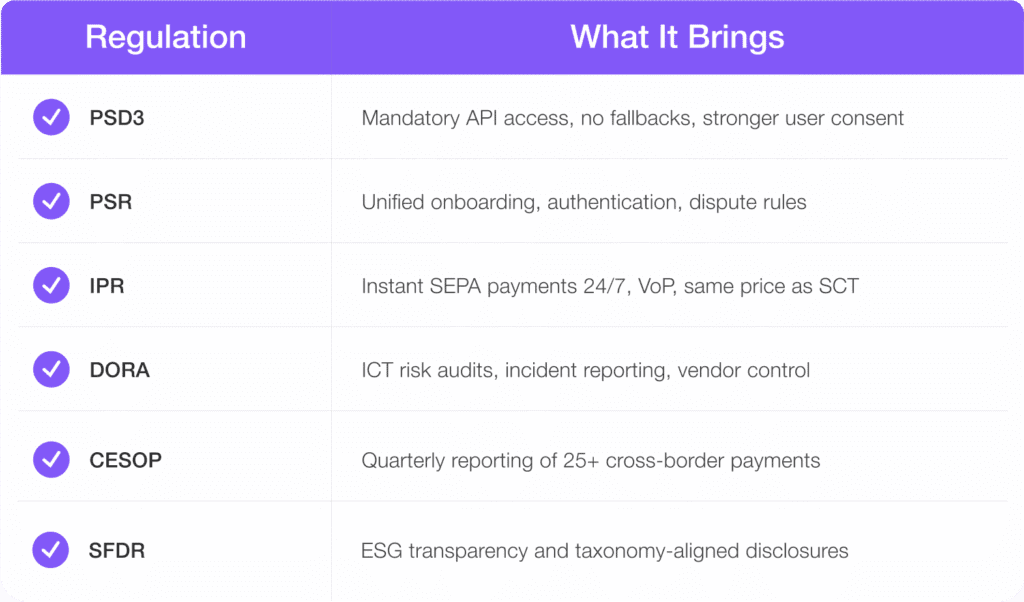

For European payment service providers, the legislative environment becomes stricter each month. The new regulatory requirements are more complicated, more technical, and more transparent. But it is also full of potential for growth, resilience, and expansion. With PSD3, DORA, CESOP, IPR, and SFDR, fast regulatory optimization is becoming a strategic business competence. In this article, we discover how the European payment regulations are changing in 2025, why they are more critical than ever before, and how PSPs can prepare, compete, and grow in the new environment.

Growth Demands Governance

The European payments market is expanding quickly and regulation is keeping up. By global estimates, the PSP industry will earn nearly $300 billion in revenue by 2030. Digitalisation, embedded finance, and the cross-border expansion of digital payments are powering the process. But the same forces propelling the industry forward also render it challenging. Cross-border fraud, digital security risks, and uncertain financial flows are pushing regulators to implement stronger frameworks for access, safety, and accountability.

PSD3 and PSR

Payment Services Directive 3 and the Payment Services Regulation go beyond simple updates to PSD2. They push for stronger API enforcement and standardization, leading to quicker transparency among payment providers, banks, and fintech firms.

PSD3 covers bottlenecks left by its predecessor. It requires using specific APIs, gets rid of insecure backup systems, and strengthens user rights when it comes to consent and data privacy. At the same time, PSR seeks to standardize how things are done across EU countries, giving one set of rules for getting started, proving who you are, and settling disagreements.

For PSPs, this implies greater technical integration with bank infrastructures and more robust real-time monitoring of API performance. Gone are the days when open banking APIs can be treated as a bolt-on. In 2025, they are audited, and unacceptable performance is no longer an option.

IPR

If there is one regulation that will have a direct impact on user experience in 2025, it is the Instant Payments Regulation. From January 2025, all eurozone PSPs must be capable of receiving SEPA Instant Credit Transfers. By October, they’re also obliged to support the sending of these payments with no pricing premium compared to traditional SEPA. But IPR is more than a technical consolidation. It requires PSPs to implement Verification of Payee (VoP) mechanisms, fraud-screening logic, and always-on liquidity provisioning. It transforms payments from a batch process to a real-time user interaction, a higher standard for transaction monitoring, reconciliation, and communication. What about the long-term impact? A new customer expectation: payments that clear in real-time, 24/7, no exception. For PSPs, this sets a new standard, technical and commercial.

DORA

The Digital Operational Resilience Act, also fully applicable from January 2025, creates the EU’s first harmonised regime for ICT risk in financial services. It aims to ensure that PSPs, as well as banks, insurers, and infrastructure providers, can detect, withstand, and recover from digital disruptions.

PSPs are required by DORA to:

- Conduct regular security and stress tests on their systems;

- Classify, report, and register ICT incidents near real-time;

- Manage and oversee third-party tech suppliers, including cloud platforms.

Above all, DORA flips the burden of proof. Resilience must be provable, documented, and auditable. PSPs that partner with third-party processors or infrastructure partners must ensure and actively oversee their compliance as well.

CESOP

The Central Electronic System of Payments, working from January 2025, holds PSPs liable for reporting cross-border transactions exceeding 25 payments per quarter per recipient. The measure is aimed at tackling VAT fraud in e-commerce, a segment that robs EU states of billions of euros in foregone revenues each year. The implications are significant. All transactions that qualify have to be labeled, in the latest XML schema format, and reported to tax authorities on a quarterly basis. For cross-border PSPs, marketplaces, platforms, and remittance services CESOP brings a considerable reporting requirement. Manual processes will not scale. Real-time tagging, audit logging, and retention policies that are secure will have to be integrated to the payment infrastructure. CESOP also rewards transparency. PSPs that can report cleanly, completely, and consistently will definitely have better relationships with tax authorities and faster onboarding when they expand into new EU markets.

SFDR and the ESG Mandate

The Sustainable Finance Disclosure Regulation and EU Taxonomy Framework are bringing environmental and social governance to the payments industry. PSPs will be required to report on sustainability-related risks, goals, and operational metrics starting in 2025.

This includes:

- Publishing ESG policies publicly (energy usage, emissions, inclusiveness);

- Considering ESG risks into product development;

- Reporting impact data in relation to taxonomy-aligned thresholds.

While SFDR may seem distant from daily transaction flows, it’s in alignment with a rising commercial trend that institutional counterparties and ESG-conscious consumers increasingly favor providers that disclose and act on sustainability information. Forward-thinking PSPs are using SFDR not only for compliance, but to present themselves as responsible innovators.

Building Regulatory Infrastructure

The challenge in 2025 isn’t to comply with five new regulations. It’s to build systems that can rapidly adapt regulatory changes and continue to deliver value without interruption.

It starts with infrastructure that scales. PSPs must invest in:

Modular APIs that evolve with PSD3 and PSR, ready for complex flows

Real-time payment engines with IPR and VoP for instant execution

Audit-ready incident response systems that comply with DORA

Automated reporting dashboards for CESOP and ESG disclosures

It also requires tighter coordination between legal, product, risk, and engineering teams. Regulations like DORA and CESOP are not just paperwork. They affect UX, transaction routing, and real-time error handling.

The Role of a Gateway Partner

A good way of dealing with this complexity is to partner with a white-label or infrastructure-native payment gateway. A gateway partner, if well selected, can remove much of the technical and regulatory burden – enabling PSPs to move faster, without compromising on compliance.

A compliant-ready gateway can provide:

- Fully PSD3-compliant APIs with SCA, VoP, and tokenisation built-in;

- IPR-compliant real-time payments with instant reconciliation;

- DORA monitoring features, including incident reporting and vendor audits;

- Pre-configured CESOP and SFDR reporting modules, exportable to regulators;

- Secure hosting with ISO/PCI certifications, reducing internal risk.

The result is a PSP that can bring new services, markets, and client offerings to market without being held back on every regulatory update.

Regulation as Growth Catalyst

While regulation brings short-term pains, it also brings long-term gains. PSPs that build in these standards early reap:

- Deeper trust with regulators, banks, and end customers;

- Faster expansion into EU markets with simplified licensing;

- Improved product quality, as a result of demonstrated durability and transparency of data;

- Tighter partnerships with banks that look for reliable, effective, forward-thinking partners.

In this way, regulation becomes more than risk management. It is the blueprint for scalable and secure payment experiences.

Conclusion

European Payment Service Providers (PSPs) will face regulatory changes in 2025, presenting both a challenge and a chance for growth and increased reliability.PSPs are moving away from just meeting basic rules and are now focusing on being ready to grow and change. Those who can adapt fast will likely do the best. Areas like API integrity, real-time payments, operational resilience, tax transparency, and ESG disclosure will continue to change.That is why PSPs must invest in compliance infrastructure.

For those who invest in effective operational systems, partnerships, and smart architectures, regulation is not a hurdle. It’s an indicator for trust, growth, and next-generation payment innovation. With the right payment gateway partner assuming the operational load, PSPs can spend less time managing mandates and more time delivering exceptional value at scale. Would your business be one of those, who are taking the advantage from this opportunity?