Published in Deep Dive, Industry

Payments in APAC: Entering in 2025

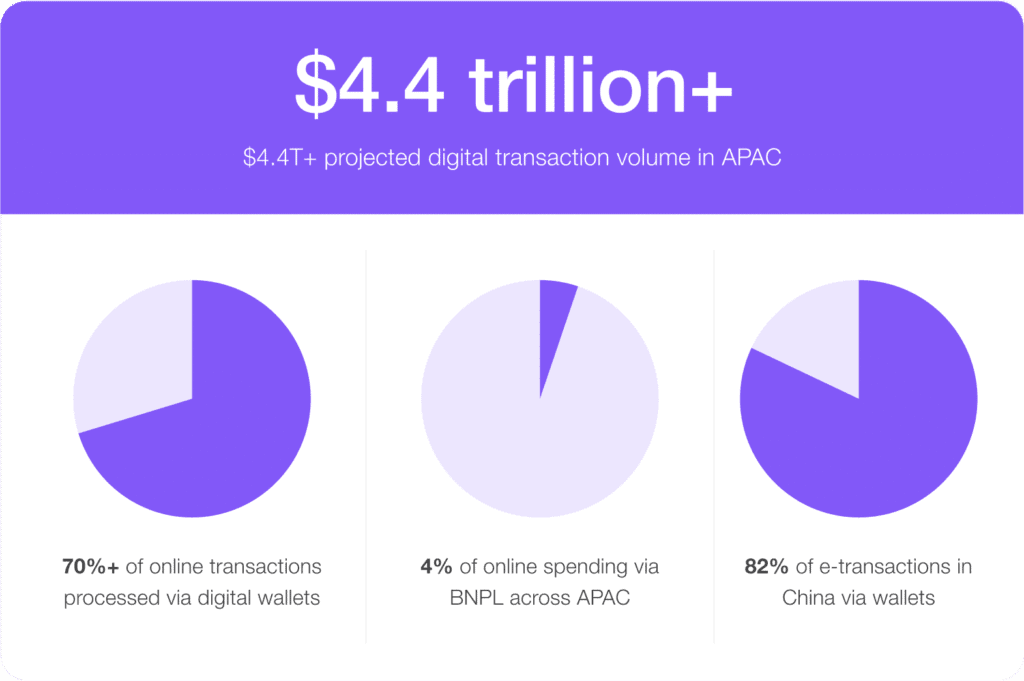

The post-pandemic demand for digital payments, driven by accelerated growth in e-commerce, has boosted the APAC digital payments market to a projected $4.4 trillion in transaction value this year. The Asia-Pacific region has some huge and rapidly growing mobile wallet systems. Payments made in real-time are also changing how payments work in places such as India, Thailand, and Singapore, which helps more people get access to financial services and boosts online shopping.

For businesses looking to get into or grow in the area, keep in mind that APAC payments are quick, work well together, and are very specific to the local area. In this article we will explore key payment specificities, companies should consider while entering APAC.

Digital Wallets

Wallets currently account for more than 70% of online transactions in APAC through 2025. Behavioural and technological drivers are both responsible. Smartphone penetration, pervasive mobile internet, and an app-centric lifestyle have created perfect conditions for mobile-first finance.

Nowhere is this more evident than in China, where Alipay and WeChat Pay account for over four-fifths of all digital transactions, where the digital wallet is standard and not exceptional. But that is just the start of the story.

In India, the uptake of apps such as Paytm, PhonePe, and Google Pay illustrates a system complete with ubiquity in daily financial operations, from e-commerce to rents, school fees, and QR code payments for shops. They are making available to millions an ability to demand new financial products without being refused basic financial services.

In Indonesia, methods such as GoPay, OVO, and Dana are integrated not just in payments but also in ride-hailing, delivery, insurance, and even savings products. In the Philippines, over 94 million customers reached its GCash alone in 2024, in effect becoming the de facto national payment vehicle for consumers and micro-merchants alike.

Digital wallets in APAC are now part of the regional payment infrastructure, covering banking, commerce, and daily life together. They’re designed to accommodate local user behaviors: low-friction onboarding, real-time confirmation of transactions, and embedding into everything from ordering food to paying taxes. In essence, wallets are the new infrastructure.

Real-Time Payment Systems

While digital wallets make the headlines with front-end user experience, it is real-time payment systems that provide the rich back-end plumbing for emerging payment experience. These country-scale systems, driven by policy vision and technical aspiration, are revolutionizing the speed, cost, and reach of digital finance.

India’s Unified Payments Interface is handling more than 10 billion transactions per month as of late 2024, it interconnects more than 300 banks and fintech channels. An interoperable, secure, and low-cost platform, it supports not only peer-to-peer payments but also merchant settlements, bill payments, and government subsidies.

In Thailand, government-supported PromptPay links national ID numbers and mobile phones to bank accounts. It’s central to public payments and small business transactions, and is now also the foundation for cross-border transactions with Singapore and Malaysia. Over 65 million Thai consumers actively make use of PromptPay for everyday essentials.

Singapore’s PayNow, on the other hand, has already been conducting real-time peer-to-peer and business-to-consumer transactions for many years and is already more interested in regional interoperability. The Monetary Authority of Singapore has collaborated with Thailand, Malaysia, and India to create an architecture under which real-time payments cross borders at low fees and latency.

These RTP infrastructures are not just functional. They demonstrate how APAC governments are constructing domestic financial rails that enhance financial inclusion, reduce reliance on traditional card networks, and offer merchants of all shapes and sizes a faster, clearer solution to legacy processors.

Credit and Debit Cards

In South Korea and Japan, card infrastructure is still highly entrenched in retail, travel, and hospitality businesses. Credit cards still account for roughly 23% of all online transactions there. It’s a function of institutional trust, ubiquitous card-linked reward systems, and highly regulated consumer protection regimes. For high-ticket transactions or business travel, cards still afford a sense of guarantee.

In Australia and Singapore, cards remain popular, particularly in the high-income segments and cross-border transactions. Cashback, miles from travel, and protection insurance still shape consumer spending behavior, even amongst digitally native consumers. But this is complementary to digital wallets, not substitutive.

Debit cards do have a bridging role in several nations in emerging markets such as India, Indonesia, and Vietnam where very large proportions of people are entering the formal economy for the first time.In India, about 17% of online buys still happen with debit cards. People often use them for paying utility bills, receiving government benefits, or making their first online purchase. Policy helps a lot with this since most debit cards connect right to government-backed bank accounts, which helps bring more people into the financial system. In summary, the pattern can be seen: use of cards is falling as a default tool but remains strong in specialized, high-trust, or cross-border uses.

BNPL

Buy Now, Pay Later is getting popular in Asia-Pacific, but what’s hot varies a lot by country. In 2023, it was 4% of online spending in the area. That number’s going up, especially in Australia, Singapore, and Malaysia, and we expect it to continue through 2025.

The appeal of BNPL in APAC lies in its value proposition: it gives credit without the frills of traditional lending.

Consumers, especially millennials and Gen Z, are turning to BNPL, as it allows them budget control, interest-free ease, and rapid checkout. BNPL is increasingly being blended into mobile commerce purchases in Malaysia. It has emerged as an omnichannel lifestyle payment tool for fashion, electronics, and travel in Australia. Singapore is a hybrid, a tech-savvy middle class with a growing appetite for transparent short-term credit. BNPL growth is not, however, being overlooked. APAC governments are now beginning to call for licensing, disclosure, and credit checks, following the lead of BNPL regulation in the UK.

QR Code Payments

One of the most distinctive payment aspects of APAC is the universality of QR code usage. In high-end retail to street vendors along the road, QR-based payments have become an habitual gesture of payment in Thailand, Vietnam, Indonesia, and the Philippines.

QR payments are so prevalent in these nations not because they are sleek or innovative, but because they’re frictionless, cheap, and interoperable. They require no point-of-sale terminals or custom apps. Simply a smartphone and a QR sticker will do.

Governments have embraced this model enthusiastically. Thailand’s PromptPay, Singapore’s PayNow, and Malaysia’s DuitNow all promote countrywide QR schemes interoperable between wallets and banks. For microenterprises in particular, QR payments are an immediate on-ramp to digital inclusion, allowing them to accept non-cash payments, send digital receipts, and access formal credit based on digital earnings.

Growing in APAC

The region’s complexityб language, regulation, payment rails, consumer behavior, and fraud riskб requires something modular, compliant, with high-availability infrastructure that can fit into the technical, cultural, and financial realities of each nation.

Among the APAC-oriented needs are:

- Domestic switch requirements

- Cross-border refund expectations

- Regulatory compliance specific to a region

- Acceptance logic across multiple wallets

CodeVision is a reliable partner, allowing businesses to smoothly enter APAC.Here’s how:

Refund Orchestration

CodeVision facilitates smart refunds, to the original method of payment, and in full accordance with refund processing timeframes in anchor markets. Refund flows are monitored, traceable, and transparent both internally

Smart Routing with Local Integration

Across APAC, there is no one size. CodeVision offers native rails and methods for every major market. By not needing to implement many local integrations independently, businesses with CodeVision integrate once into a single API and benefit from regionally aware routing.

Infrastructure Resilience and Compliance Readiness

No downtime is accepted in APAC’s mobile-first, always-on economy. CodeVision is 99.999% available with complete failover logic, regional hosting of data, and compliance assistance for regional legislative requirements.

Conclusion

Digital wallets, real-time payments, BNPL, and QR codes are the way Asia-Pacific is building a payment ecosystem on mobile behavior, financial inclusion, and digital trust. For businesses, the secret to successfully entering the market is to build for responsiveness, rather than for rigidity. It is creating payment experiences that are local in character, real-time in function, and consistent in result. CodeVision makes that possible. Not only by enabling payments, but by offering businesses the infrastructure to scale.