Published in Deep Dive, Product

Tokenization: Why It Matters, and How to Make It Work in 2025

Friction during the payment moment drives revenue loss. Compliance gaps open the door for fines and loss of reputation. And between them, the continuous consumption of online fraud eats away at trust. There is one technology that addresses all three at once: network tokenization. Network tokenization will be valued at $4.1 billion in revenue this year, growing to $8.9 billion by 2029. Visa has emitted over 4 billion tokens since its inception, cutting fraud by 28% and increasing approval rates on transactions by 3%.In this article we explore how exactly this technology works and how businesses can maximise its use.

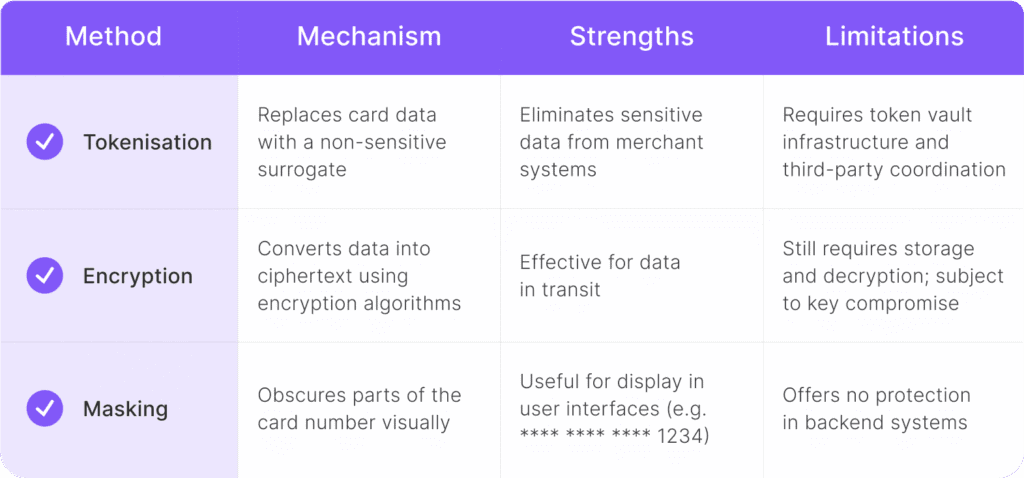

What Is Tokenization?

Tokenization is a security feature that replaces a customer’s true card number with a unique, context-specific token. The token may be stored safely and reused in subsequent transactions. When it is swiped or reused in the incorrect context, it is worthless.

What sets network tokenization apart from the rest is its pairing with the issuer network. Global card networks such as Visa, Mastercard, and American Express issue the tokens. This ensures compatibility, better security, and automatic updates when cards are replaced due to expiration.

Every token is:

Merchant-specific

It will only work within a specific merchant, platform, or device environment.

Non-reversible

The original card number stays hidden because it’s impossible to decrypt it.

Auto-refreshing

When a credit card is updated, the payment token will also update automatically, without requiring you to do anything.

The end result is a payment method that’s more secure to store, more intelligent to process, and simpler to keep up to date.

There are various drivers that have come together to make tokenization not only timely but essential in 2025

Why Is Tokenization Important?

Fraud Risks

Statista has estimated the payment fraud losses online worldwide at over $48 billion in 2025, up from $41 billion in 2022. Attackers are exploiting weaknesses in the legacy payment systems, specifically those that use raw card data. Tokenization prevents real card information from being in the transaction flow. Even during a break-in, the compromised data is useless everywhere except in its natural environment. This reduces merchant risk and fraud loss considerably.

Seamless Payments

Customers today expect frictionless, one-click payment experiences. The requirement of re-typing card details, or breaking at checkout, will kill a purchase. Typical cart abandonment can range from 70% with checkout friction being a leading amongst top reasons. Tokenization supports technologies like Click to Pay and biometric checkouts, allowing customers to pay immediately, without re-entering the card information.

Recurring Revenue

For subscription-based merchants or those who retain payment information, declined and re-issued cards are the risk of revenue disruption. One declined charge is the risk of losing the customer. Network tokenization does this automatically, refreshing tokens every time the card the token refers to is replaced. It keeps billing systems running at all times and avoids recurring revenue from being disrupted by technical issues.

Compliance Pressure

Data protection laws are getting stricter. PCI DSS has more stringent controls for the cardholder data environment. GDPR and PSD2 say companies must have good reasons and process as little personal data as possible. If they don’t, they could face fines, audits, or a hit to their reputation.Tokenization offers the possibility of avoiding most of these compliance threats. By eliminating cardholder data from merchant systems, it minimises the audit scope and needs fewer controls.

The Advantages of Tokenization

Tokenization has certain advantages in three broad categories: fraud prevention, operational efficiency, and customer satisfaction.

Fewer Fraud and Chargebacks

Juniper Research puts the potential fraud averted through tokenisation at as much as 26%. Tokens being linked to a singular use case and device, elsewhere than in such conditions, make them useless.

Passing on the liability minimises exposure to chargebacks and the indirect fraud resolution costs: customer dissatisfaction, staff time, and dispute fees. Fewer declined payments mean more successful checkouts. Visa claims that tokenized transactions have an average approval rate that is 3% better. For subscription platforms and high volume merchants, that small boost can add up to millions of revenues saved.

Enhanced User Experience

The customer today expects a frictionless checkout. Any request to re-enter card data or agree to further actions can cause drop-offs. Tokenization allows frictionless experiences like Click to Pay and biometric payments. Because tokens are context-aware, they enable stored credentials which are channel- and device-independent without loss of security. This creates a more seamless experience for repeat purchase, subscription renewal, and incentive-based loyalty.

Native Support

Tokenization makes transactions smoother and safer across different devices, which helps omnichannel commerce grow. For example, Mastercard has seen a 50% increase each year in token use for mobile, IoT, and online shopping

The Role of the Payment Gateway

While tokenization is made public and standardised at the network level, its real performance and application indeed rely to a large degree on the payment gateway. Here’s how reliable payment gateway can boost tokenization:

Frictionless Integration

The gateways now are making tokenization widely adopted without calling on the existing infrastructure to be upgraded. That is to provide API-first, backwards-compatible integration. Merchants need to be able to tokenize cards at first contact without adding friction to the customer experience. Gateways with real-time token provisioning during checkout enable frictionless UX while setting the stage for long-term secure card-on-file storage.

Handling the Token Lifecycle

Tokens are not permanent objects. Tokens will eventually expire. The customer might change banks. Cards are replaced or re-issued. An effective gateway updates token information in real-time against the issuing bank for sync. This feature reduces the usual problems of payment failure, retry loops, and churn. It keeps the merchant always gathering good credentials, even if the card has been moved.

Providing Compliance Visibility

Tokenization facilitates compliance but still requires businesses to demonstrate their security posture to regulators, banks, and auditors. The payment gateway must provide functionality for monitoring:

- How and when tokens were issued

- How they’re stored

- How they’re replaced or retired

- Who has access

This is required by companies operating in PCI DSS, GDPR, PSD2, and CCPA regimes, and will continue to become increasingly important, especially in cross-border transactions.

Conclusion

From being an anti-fraud method, tokenization now is a capability at the infrastructure level. It can ensure critical business goals: revenue continuity, customer retention, compliance, and brand trust. Storing raw card data in the back, using static credentials, or waiting on security upgrades can only work, though, if it is done right. That means tokenisation early in onboarding, interoperable architecture, fraud-smart infrastructure, and a gateway partner which offers visibility, automation, and lifecycle control.